Car insurance premiums for new drivers are akin to steep mountains, rising with every passing year. This article delves into the reasons behind why these inexperienced motorists face higher insurance costs compared to their seasoned counterparts.

Through an analytical lens, we explore the impact of limited driving experience on risk assessment and the subsequent likelihood of accidents and claims. Additionally, we examine how age acts as a determining factor in setting insurance premiums for new drivers.

Lastly, strategies will be discussed to help alleviate the burden of high insurance costs for these individuals seeking understanding and guidance in this complex realm.

Risk Assessment for New Drivers

The risk assessment for new drivers involves evaluating factors such as lack of driving experience, higher likelihood of engaging in risky behavior, and increased vulnerability to accidents. Driver training programs aim to provide new drivers with the necessary skills and knowledge to navigate the road safely. These programs typically cover topics such as traffic rules, defensive driving techniques, and hazard awareness.

However, even with driver training programs in place, insurance industry statistics consistently show that new drivers are more likely to be involved in accidents compared to experienced drivers. Insurance companies rely on these statistics when determining premiums for new drivers. The lack of driving experience increases the probability of errors or mishaps on the road. Furthermore, research indicates that young and inexperienced drivers are more prone to engage in risky behaviors such as speeding or distracted driving.

Moreover, due to their limited exposure to real-world driving situations, new drivers have a greater vulnerability to accidents. They may struggle with decision-making under pressure or fail to anticipate potential hazards effectively. These factors contribute significantly to the higher insurance costs for new drivers.

Lack of Driving Experience and Its Impact on Insurance Rates

Lack of driving experience significantly influences the determination of insurance rates for individuals with less time behind the wheel. Insurance industry trends for new drivers reveal that insurance companies consider lack of driving experience as a major risk factor in determining insurance rates. New drivers are more likely to be involved in accidents and make claims, which can increase the cost of insurance premiums. This is because inexperienced drivers tend to have less developed skills and may not possess the same level of judgment and decision-making abilities as experienced drivers.

One way to mitigate this risk is through driving schools. Driving schools provide formal education and training programs that aim to improve road safety and enhance driving skills. Completion of a recognized driving school program can demonstrate a commitment towards safe driving practices, leading insurers to offer lower rates for those who have successfully completed such programs.

Driving schools also provide opportunities for new drivers to gain practical experience under supervised conditions, allowing them to develop important skills before taking on full responsibility on the road. Insurers recognize this additional training provided by driving schools and may reward new drivers with lower premiums as they pose a reduced risk compared to those without any formal training or minimal practice.

Higher Likelihood of Accidents and Claims Among New Drivers

Inexperienced motorists have a higher propensity for accidents and claims compared to their more seasoned counterparts. This increased risk factor is one of the primary reasons why car insurance premiums tend to be higher for new drivers. The lack of driving experience exposes them to various challenges on the road, making them more vulnerable to accidents.

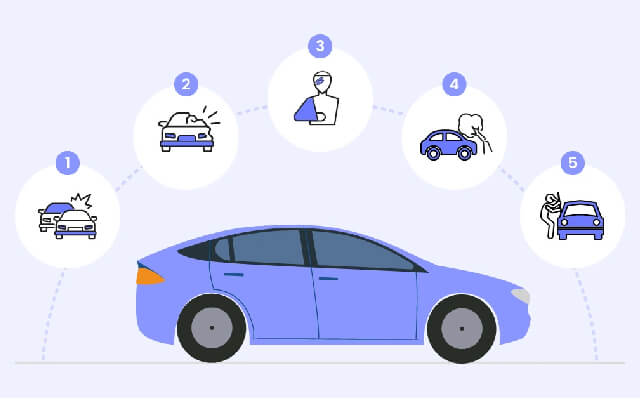

Here are three key factors that contribute to the higher likelihood of accidents and claims among new drivers:

- Limited situational awareness: New drivers often struggle with assessing potential risks on the road due to their limited exposure and lack of familiarity with different driving scenarios.

- Poor judgment and decision-making: Inexperienced motorists may face challenges in properly evaluating situations, leading them to make errors in judgment when it comes to following traffic rules or reacting promptly in unexpected circumstances.

- Lack of skill in handling complex driving situations: New drivers may not possess the necessary skills to handle challenging scenarios, such as adverse weather conditions or navigating high-traffic areas effectively.

These risk factors significantly increase the probability of accidents and subsequent insurance claims among new drivers, prompting insurance providers to charge higher premiums for this demographic group. By considering these factors, insurers aim to accurately reflect the level of risk associated with insuring inexperienced motorists while maintaining a fair pricing structure for all policyholders.

The Role of Age in Determining Insurance Premiums for New Drivers

Age is a significant determining factor in the calculation of insurance premiums for novice motorists. Insurance companies consider age as an important risk indicator due to its correlation with driving experience and maturity level. Younger drivers, particularly those between the ages of 16 and 24, are more likely to engage in risky behavior while driving, such as speeding or distracted driving. This increased risk is reflected in higher insurance premiums for this age group.

In addition to age, the role of gender also plays a part in determining insurance premiums for new drivers. Statistically, young male drivers have been found to be involved in more accidents and make more claims compared to their female counterparts. Consequently, insurance companies often charge higher premiums for young males due to their perceived higher risk.

Moreover, the impact of location on insurance premiums cannot be ignored. Certain areas may have higher rates of accidents or vehicle thefts, leading insurers to increase premiums for drivers residing in these regions. Urban areas tend to have more congested roads and greater exposure to potential risks compared to rural areas.

Overall, when calculating insurance premiums for new drivers, age plays a crucial role alongside other factors such as gender and location. These factors help insurers assess the level of risk associated with insuring novice motorists and determine appropriate premium rates accordingly.

Strategies to Lower Insurance Costs for New Drivers

One strategy to reduce insurance expenses for novice motorists is to enroll in a defensive driving course. This can potentially result in lower premiums due to the increased level of driver education and risk reduction. Defensive driving courses provide valuable training that helps new drivers develop essential skills and knowledge needed for safe and responsible driving. By completing such a course, new drivers can demonstrate their commitment to becoming better drivers, which may lead to insurance discounts.

Here are three ways in which new drivers can save money on their insurance:

- Good Student Discount: Many insurance companies offer discounts for students who maintain good grades. By achieving high academic performance, new drivers can show responsibility and dedication, leading insurers to consider them as less risky.

- Multi-Policy Discounts: Bundling multiple policies with the same insurer, such as car and home insurance, often leads to significant savings on premiums. New drivers can explore this option by comparing quotes from different insurers.

- Telematics Devices: Some insurers offer telematics programs that monitor driving behavior through a device installed in the vehicle or using smartphone apps. Safe driving habits like obeying speed limits and avoiding sudden accelerations or hard braking can result in lower premium rates for new drivers.

Frequently Asked Questions

What Factors Are Considered in the Risk Assessment for New Drivers?

Factors considered in the risk assessment for new drivers include driving record, which evaluates their history of accidents or traffic violations. These risk factors contribute to the higher cost of car insurance for new drivers compared to experienced ones.

How Does the Lack of Driving Experience Affect Insurance Rates for New Drivers?

The effect of inexperience on insurance rates for new drivers is significant. Due to their lack of driving history and increased risk, insurers charge higher premiums to cover potential financial liabilities associated with accidents or claims.

Are There Any Specific Statistics or Data to Support the Higher Likelihood of Accidents and Claims Among New Drivers?

New drivers accident statistics reveal a higher likelihood of accidents and claims among this group. Additionally, gender has been shown to impact insurance rates for new drivers, further contributing to the increased cost of their car insurance.

Besides Age, What Other Factors Play a Role in Determining Insurance Premiums for New Drivers?

Factors influencing insurance premiums for new drivers include their driving history, type of vehicle, and location. Ways to reduce insurance costs for new drivers can include taking driver education courses and maintaining a clean driving record.

What Are Some Effective Strategies That New Drivers Can Use to Lower Their Insurance Costs?

Strategies for reducing insurance costs and building driving experience effectively are important considerations for new drivers. By implementing effective strategies such as completing driver education courses, maintaining a clean driving record, and choosing a car with lower insurance rates, new drivers can potentially lower their insurance costs.

Conclusion

In conclusion, the higher cost of car insurance for new drivers compared to experienced drivers can be attributed to several factors.

Firstly, their lack of driving experience leads to increased risk and a higher likelihood of accidents and claims.

Additionally, age plays a significant role in determining insurance premiums for new drivers.

However, there are strategies available that can help lower insurance costs for new drivers.

By understanding these factors and implementing appropriate measures, new drivers can navigate the road safely while managing their insurance expenses effectively.