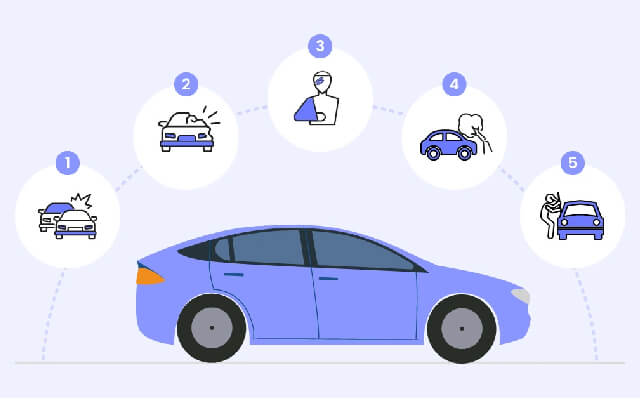

Car insurance is a necessary financial safeguard for vehicle owners. This article provides an objective analysis of the different types of car insurance coverage available to individuals.

By examining liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage, readers will gain a comprehensive understanding of their options and potential benefits.

The aim is to present factual information that aids in decision-making for those seeking knowledge about car insurance policies.

Liability Coverage

Liability coverage is a type of car insurance that provides financial protection to the policyholder in the event they are found legally responsible for causing bodily injury or property damage to others. It is an essential component of any auto insurance policy as it helps safeguard the insured individual from potential lawsuits and hefty expenses resulting from accidents.

One aspect of liability coverage that should be considered is liability limits. These limits define the maximum amount that an insurance company will pay out in the event of a covered claim. They are typically expressed as two numbers, such as 25/50 or 100/300, where the first number represents the maximum amount payable per injured person and the second number represents the maximum amount payable per accident. The higher these limits, the more financial protection an individual has if they are found liable for causing harm.

Bodily injury coverage is another crucial element within liability coverage. This aspect provides financial assistance for medical costs, rehabilitation expenses, and even lost wages due to injuries sustained by other parties involved in an accident caused by the insured driver. It ensures that individuals who suffer bodily harm receive appropriate compensation for their injuries.

Collision Coverage

Coverage for collisions provides financial protection in the event of physical damage to a vehicle resulting from an impact with another object. This type of insurance is optional, but it can be beneficial for individuals who want to protect their investment in their vehicle. Collision coverage typically has deductible options that policyholders can choose from. A deductible is the amount that the policyholder must pay out-of-pocket before the insurance company covers the remaining cost of repairs.

There are several factors that can affect collision coverage rates:

- Driving record: Insurance companies consider a driver’s past accidents and violations when determining rates for collision coverage. Those with a history of accidents or traffic violations may face higher premiums.

- Vehicle make and model: The type of vehicle being insured can also impact rates. Vehicles with higher price tags or those considered more expensive to repair may have higher collision coverage rates.

- Location: The area where the insured vehicle is primarily driven and parked can influence rates as well. Higher crime rates or areas prone to accidents may result in increased premiums.

Understanding these factors and selecting an appropriate deductible option can help individuals make informed decisions when purchasing collision coverage for their vehicles.

Comprehensive Coverage

The cost of comprehensive coverage is influenced by a variety of factors such as the age and condition of the vehicle, the deductible chosen, and any additional features or protections included in the policy. Comprehensive coverage provides benefits that go beyond collision coverage. It protects against damage to your vehicle from non-collision events such as theft, vandalism, fire, or natural disasters.

One factor that affects comprehensive coverage premiums is the age and condition of the vehicle. Newer vehicles with advanced safety features may qualify for lower premiums due to their reduced risk of accidents or theft. On the other hand, older vehicles might have higher premiums because they are more susceptible to damage or theft.

Another important factor is the deductible chosen by policyholders. A higher deductible typically results in lower premium costs since you are assuming more risk before insurance kicks in. However, it’s crucial to consider whether you can afford a high deductible if an incident occurs.

Moreover, additional features or protections included in the policy can also impact comprehensive coverage premiums. For example, policies that include extras like roadside assistance or rental car reimbursement will likely have higher premiums compared to basic comprehensive coverage policies.

Personal Injury Protection (PIP

Medical expenses and lost wages related to injuries sustained in an automobile accident are covered by Personal Injury Protection (PIP). PIP coverage is a type of insurance that provides benefits for individuals injured in car accidents, regardless of who is at fault. It is mandatory in some states, while optional in others.

Benefits of PIP coverage include:

- Medical Expenses: PIP coverage pays for medical treatments, hospital stays, surgeries, medications, rehabilitation therapy, and other necessary medical expenses resulting from the accident.

- Lost Wages: PIP coverage compensates policyholders for lost income due to their inability to work while recovering from their injuries sustained in the car accident.

- Funeral Expenses: In unfortunate cases where a person dies as a result of an automobile accident, PIP coverage may also cover funeral expenses.

Requirements for PIP coverage vary by state. Some states have no-fault insurance systems that require drivers to carry a minimum amount of PIP coverage. Other states follow a traditional fault-based system where PIP coverage is not mandatory but can be purchased as an optional add-on to existing auto insurance policies.

Overall, Personal Injury Protection (PIP) provides essential financial protection to individuals injured in car accidents by covering medical expenses, lost wages, and even funeral costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is a type of policy that provides financial protection to individuals who are involved in car accidents with drivers who do not have sufficient insurance coverage. This coverage is designed to compensate the insured for injuries and damages caused by uninsured or underinsured motorists.

When an individual is involved in a car accident, they typically file a claim with their own insurance company. If the at-fault driver does not have insurance or has insufficient coverage, the insured can make an uninsured motorist claim with their own insurer. Uninsured motorist claims cover medical expenses, lost wages, and property damage resulting from the accident.

Underinsured motorist benefits come into play when the at-fault driver has insurance but their policy limits are not enough to fully compensate the injured party. In such cases, the injured party can seek additional compensation through their underinsured motorist coverage.

It is important for individuals to consider adding uninsured/underinsured motorist coverage to their auto insurance policies as it provides an extra layer of financial protection in case of accidents involving drivers who lack adequate insurance. By having this type of coverage, individuals can ensure that they are protected against potential losses resulting from accidents caused by uninsured or underinsured motorists.

Frequently Asked Questions

Can Liability Coverage Also Protect Me From Being Sued if I Cause an Accident?

Liability coverage provides financial protection to the insured party in the event of an accident where they are at fault. While it can cover costs related to lawsuits, it does not provide coverage for hit and run incidents.

Does Collision Coverage Cover the Cost of Repairs if My Car Is Damaged in a Hit-And-Run Incident?

Collision coverage typically provides protection for the cost of repairs when a vehicle is damaged in a hit-and-run incident. Additionally, it may also cover damages caused by uninsured drivers, thereby offering financial security in such situations.

What Types of Incidents Are Typically Covered Under Comprehensive Coverage?

Typically, incidents covered under comprehensive coverage include theft, vandalism, fire, natural disasters, and collisions with animals. Comprehensive coverage provides financial protection for damages to a vehicle that are not caused by a collision.

Can Personal Injury Protection (Pip) Be Used to Cover Medical Expenses for Passengers in My Car?

Personal injury protection (PIP) can be utilized to cover medical expenses for passengers in a car. PIP benefits provide coverage for bodily injuries sustained by individuals, regardless of fault, within the scope of the policy.

If I Have Uninsured/Underinsured Motorist Coverage, Am I Still Responsible for Paying My Deductible if I’m Involved in an Accident With an Uninsured Driver?

Uninsured/underinsured motorist coverage does not typically cover the deductible for property damage. In the event of an accident with an uninsured driver, the insured is generally responsible for paying their own deductible.

Conclusion

The article discusses various types of car insurance, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type of coverage serves a specific purpose in providing financial protection to drivers in different situations. It is important for individuals to understand these types of car insurance and determine which ones are necessary based on their needs and circumstances.

By having the right insurance coverage, drivers can have peace of mind knowing that they are financially protected in the event of an accident or damage to their vehicle.

In conclusion, choosing the right car insurance is essential for every driver. Whether it’s liability coverage to protect against damages caused by your actions or comprehensive coverage to safeguard against theft or natural disasters, having the appropriate insurance ensures financial security. As the saying goes, ‘better safe than sorry.’ So don’t delay; get the right car insurance today and drive with confidence knowing you’re covered for any unforeseen circumstances.