In the realm of car insurance, it is crucial for individuals to consider additional coverage options beyond the basic requirements.

This article aims to provide an informative analysis of various commonly overlooked, must-have, specialty, enhanced, and money-saving coverage options available in the market.

By adhering to academic writing standards that emphasize objectivity and impersonality without personal pronouns, this article offers a knowledgeable exploration of these coverage alternatives.

The ensuing discussion will assist readers in gaining a comprehensive understanding of additional coverage options for their car insurance needs.

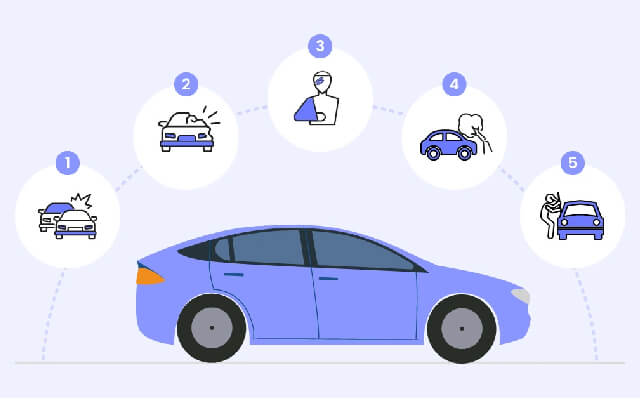

5 Commonly Overlooked Coverage Options for Car Insurance

One area that is often overlooked when considering car insurance coverage options is the inclusion of uninsured/underinsured motorist coverage. While many individuals focus on more common coverage options such as liability, collision, and comprehensive, uninsured/underinsured motorist coverage offers additional protection in the event of an accident involving a driver without sufficient insurance or no insurance at all.

Uninsured/underinsured motorist coverage provides financial support to policyholders who are involved in accidents caused by drivers who do not have enough insurance to cover the damages. This type of coverage can help offset medical expenses, property damage costs, and even lost wages resulting from the accident. Despite its importance, uninsured/underinsured motorist coverage remains one of the lesser-known or uncommon coverage options available to consumers.

5 Must-Have Additional Coverage Options for Car Insurance

A recommended set of essential coverage options for automobiles includes comprehensive, collision, uninsured/underinsured motorist, and personal injury protection. However, there are additional coverage options that are often uncommonly considered but can be seen as must-have add-ons for car insurance. These options provide valuable protection against various risks and potential financial losses.

- Roadside assistance: This coverage option provides assistance in case of emergencies such as a flat tire, dead battery, or running out of fuel. It ensures that drivers have access to help whenever they encounter unexpected incidents on the road.

- Rental reimbursement: If your vehicle is being repaired due to an accident or covered event, this coverage option helps cover the cost of renting a substitute vehicle. It provides convenience and peace of mind knowing that you won’t be stranded without transportation during the repair process.

- Gap insurance: In the unfortunate event that your vehicle is declared a total loss after an accident or theft, gap insurance covers the difference between what you owe on your car loan and its actual cash value determined by your insurer. This option prevents you from being financially responsible for paying off a loan on a vehicle you no longer possess.

Considering these uncommonly considered coverage options can enhance your overall auto insurance policy by providing additional protection and peace of mind in various situations.

5 Specialty Coverage Options to Consider for Car Insurance

Specialty coverage options for automobiles can provide specialized protection against specific risks and potential financial losses. These optional coverage choices are designed to meet the unique needs of policyholders who require additional protection beyond what is offered by standard car insurance policies. Specialized policies offer coverage for specific situations or events that may not be covered under a basic auto insurance policy.

One example of specialty coverage is gap insurance, which covers the difference between the actual cash value of a vehicle and the amount still owed on an auto loan in the event of a total loss. This type of coverage can be beneficial for individuals who have financed their vehicles and want to avoid being left with outstanding debt in case of theft or accident.

Another specialized policy option is rental reimbursement coverage, which provides compensation for rental car expenses while an insured vehicle is being repaired after an accident. This type of coverage can help alleviate the financial burden associated with renting a temporary replacement vehicle during repairs.

In addition, there are other specialty coverage options available such as roadside assistance, which provides services like towing, fuel delivery, and locksmith services in case of emergencies. There are also policies that offer coverage specifically tailored for classic cars or antique vehicles.

Overall, specialty coverage options offer additional protection and peace of mind to those seeking comprehensive insurance solutions that address their specific needs and concerns beyond what is typically included in standard car insurance policies.

5 Enhanced Coverage Options to Protect Your Car and Finances

Enhanced coverage options provide added protection for both your vehicle and financial well-being. Car insurance is a crucial aspect of responsible vehicle ownership, as it helps mitigate potential risks and expenses associated with accidents, theft, or damage. To enhance your car insurance coverage, there are unique options available that go beyond the basic policies. These innovative ways can provide additional security and peace of mind.

- Gap Insurance: This coverage option pays the difference between what you owe on your car loan or lease and the actual cash value of your vehicle if it gets totaled in an accident. It ensures that you won’t be left with a significant financial burden in case of a total loss.

- Roadside Assistance: Having this coverage offers great convenience and support when faced with unexpected breakdowns or emergencies on the road. It typically includes services like towing, tire changes, lockout assistance, fuel delivery, and more.

- Rental Reimbursement: In the event of an accident or covered loss that leaves your vehicle temporarily unusable for repairs, rental reimbursement provides compensation for renting a replacement car while yours is being fixed.

5 Extra Coverage Options That Can Save You Money in the Long Run

By exploring alternative coverage choices beyond the standard policies, individuals can potentially reduce long-term expenses associated with vehicular incidents and unexpected situations.

Two such options are bundled coverage and usage-based coverage for car insurance.

Bundled coverage options for car insurance involve combining multiple policies under a single insurer. For instance, an individual may choose to bundle their car insurance policy with their homeowner’s or renter’s insurance policy. This can result in cost savings through discounts or reduced premiums offered by insurers as an incentive to consolidate policies.

Usage-based coverage options for car insurance utilize telematics technology to monitor driving behavior and customize premiums based on actual usage patterns. Insurers collect data on factors such as mileage, speed, acceleration, and braking habits to assess risk levels accurately. By rewarding safe driving practices with lower premiums, usage-based coverage encourages responsible behavior behind the wheel.

Both bundled coverage and usage-based coverage provide opportunities for individuals to save money in the long run by tailoring their car insurance policies to suit their specific needs and circumstances. It is essential for individuals to research these options thoroughly, comparing costs and benefits from different insurers before making a decision that aligns with their financial goals and risk tolerance.

Frequently Asked Questions

Are There Any Coverage Options Specifically for Rental Cars?

Coverage options for rental cars are available to provide additional protection when renting a vehicle. These options may include collision damage waiver, liability coverage, and personal accident insurance specifically tailored for rented vehicles. Additionally, coverage options for leased vehicles may also be offered by car insurance providers.

What Coverage Options Are Available for Classic or Vintage Cars?

Coverage options for classic or vintage car insurance typically include agreed value coverage, which ensures the vehicle’s worth is covered in case of total loss, and specialized repair coverage for antique parts.

Is There a Coverage Option for Personal Belongings Stolen From My Car?

Coverage options for personal belongings stolen from a car typically fall under comprehensive car insurance. Other coverage options include protection against personal injury in car accidents and damage caused by natural disasters or weather-related events.

Can I Get Coverage for Mechanical Breakdowns or Repairs?

Coverage for engine failures and transmission repairs can be obtained through additional coverage options for car insurance. These options provide financial protection against the costs associated with mechanical breakdowns or repairs to the vehicle’s engine or transmission.

Are There Any Coverage Options for Accidents Caused by Uninsured or Underinsured Drivers?

Coverage options for accidents caused by uninsured or underinsured drivers include uninsured motorist coverage and underinsured motorist coverage. These options provide financial protection in the event of an accident with a driver who lacks sufficient insurance. Rental car coverage is another additional option that can be beneficial.

Conclusion

In conclusion, when it comes to car insurance, there are various additional coverage options available that can provide extra protection and financial security. It is important for policyholders to carefully consider these options to ensure they have adequate coverage for their individual needs.

One interesting statistic to note is that according to a survey conducted by the Insurance Information Institute, only 20% of drivers in the United States fully understand their car insurance coverage. This highlights the need for increased awareness and education regarding the different coverage options available, emphasizing the importance of making informed decisions when selecting car insurance policies.