Choosing the best car insurance requires careful consideration of various factors. This article aims to provide an unbiased and analytical guide for individuals seeking to select appropriate coverage options.

By understanding these options and evaluating different insurance providers, one can make an informed decision. Additionally, comparing quotes and premiums allows for a comprehensive assessment of available choices.

The goal is to equip readers with the knowledge necessary to navigate the complex landscape of car insurance effectively.

Factors to Consider

Factors that should be considered when choosing the best car insurance include coverage options, deductibles, premiums, and customer reviews.

One important factor to consider is the reputation of the insurance provider. A reputable insurance company is one that has a history of providing reliable and efficient service to its customers. This can be determined by looking at their track record in terms of customer satisfaction and their financial stability.

It is also crucial to evaluate the customer service offered by the insurance company. Good customer service ensures that policyholders receive prompt assistance and support when needed. This includes easy access to information, helpful representatives who can answer questions or provide guidance, and efficient claims processing procedures.

Customer reviews play a significant role in assessing an insurance company’s reputation and level of customer service. Reading reviews from current or former policyholders can give insights into how well the company responds to inquiries or handles claims.

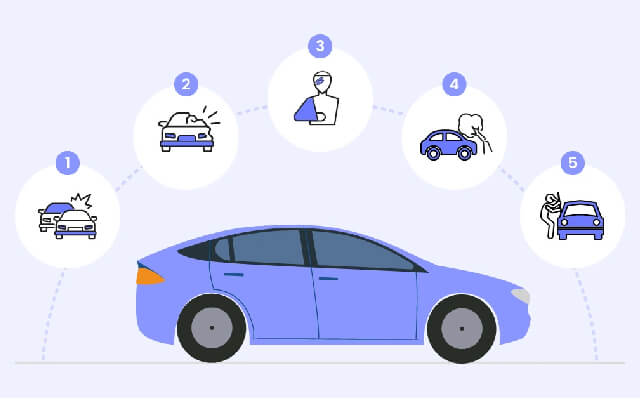

Understanding Coverage Options

One important aspect to consider when evaluating car insurance policies is a thorough understanding of the available coverage options. This knowledge allows individuals to make informed decisions and select the policy that best suits their needs.

Two key components of car insurance coverage options are deductible options and policy limits.

Understanding deductible options is crucial as it determines the amount an individual must pay out-of-pocket before their insurance coverage kicks in. Higher deductibles typically result in lower premium costs, but they also mean greater financial responsibility in the event of an accident.

Policy limits refer to the maximum amount an insurance company will pay for covered claims. It is essential to carefully assess these limits to ensure adequate protection against potential financial losses. Insufficient policy limits can leave individuals vulnerable if damages exceed the coverage provided by their policy.

Evaluating Insurance Providers

When evaluating insurance providers, it is important to consider their reputation in the industry and the financial stability of the company. One way to assess an insurance provider’s reputation is by looking at insurance company ratings. These ratings are typically compiled by independent agencies that evaluate insurers based on various factors such as financial strength, customer service, and claims handling.

Insurance company ratings serve as a useful tool for consumers to gauge the reliability and trustworthiness of an insurer. They provide insights into the company’s ability to fulfill its obligations and pay claims promptly. Commonly used rating agencies include A.M. Best, Standard & Poor’s (S&P), Moody’s, and Fitch Ratings.

In addition to insurance company ratings, customer reviews can also offer valuable information when evaluating insurance providers. Customer reviews provide firsthand accounts of individuals’ experiences with different insurers. These reviews can shed light on aspects such as customer service quality, claims processing efficiency, and overall satisfaction.

While it is essential to consider both insurance company ratings and customer reviews when evaluating providers, it is crucial not to rely solely on either one but rather take a holistic approach in assessing an insurer’s suitability for your needs. By considering these factors together, you can make a more informed decision about which insurance provider best aligns with your requirements while ensuring financial stability and a positive reputation within the industry.

Comparing Quotes and Premiums

An important aspect of comparing quotes and premiums is to carefully analyze the coverage options provided by different insurance providers. This allows individuals to make an informed decision regarding their car insurance needs.

When comparing quotes and premiums, it is crucial to consider the following:

- Discounts: Insurance providers often offer various discounts that can help reduce premiums. These discounts may include good driver discounts, multi-policy discounts, or safety feature discounts. Understanding the available discounts can significantly impact the overall cost of insurance.

- Deductible Options: The deductible is the amount that policyholders must pay out of pocket before their insurance coverage kicks in. Different insurers offer different deductible options, allowing individuals to choose a deductible level that aligns with their financial situation and risk tolerance.

- Coverage Limits: Insurance policies come with specific coverage limits for liability, property damage, and medical expenses. It is essential to compare these limits across different quotes to ensure adequate protection in case of an accident.

- Additional Benefits: Some insurance providers may offer additional benefits like roadside assistance or rental car reimbursement. Evaluating these additional benefits can provide added value when comparing quotes.

Making an Informed Decision

To make an informed decision, it is crucial for individuals to carefully evaluate and compare the coverage options, discounts, deductible choices, coverage limits, and additional benefits provided by different insurance providers.

Researching customer reviews can provide valuable insights into the experiences of other policyholders with a particular insurance company. These reviews can help identify any recurring issues or concerns that may affect the overall satisfaction with the insurer.

Seeking expert advice from professionals in the insurance industry can also be beneficial. Insurance brokers or agents have extensive knowledge of various insurance policies and can offer guidance on which policy would best suit an individual’s needs. Additionally, they can provide information about the financial stability and reputation of different insurers.

It is important to consider both positive and negative feedback when researching customer reviews and seeking expert advice to gain a comprehensive understanding of an insurer’s performance.

Frequently Asked Questions

How Does My Credit Score Affect My Car Insurance Rates?

The impact of credit score on auto insurance pricing is a significant factor. A higher credit score generally leads to lower rates, while a lower credit score can result in higher premiums. Improving one’s credit score can potentially lead to better car insurance rates.

Can I Get Car Insurance Coverage for a Rental Vehicle?

Rental vehicle insurance refers to coverage options for rental cars, including rental car reimbursement and meeting rental car insurance requirements. Understanding these options is essential for individuals seeking appropriate coverage when renting a vehicle.

What Happens if I Let Someone Else Drive My Car and They Get Into an Accident?

Liability implications arise if an accident occurs when someone else is driving a car that is not insured under their name. Insurance coverage extension may provide protection, but it is crucial to review policy terms and conditions.

Will My Car Insurance Rates Increase if I File a Claim?

The impact of filing a claim on car insurance rates varies depending on the policy and the specific circumstances. Some insurers offer accident forgiveness, which may prevent rate increases after an initial claim.

What Is the Difference Between Comprehensive and Collision Coverage?

The difference between comprehensive and collision coverage lies in the types of damage they cover. Comprehensive covers non-accident-related damages like theft or natural disasters, while collision covers damages resulting from accidents. These factors can affect car insurance rates.

Conclusion

Choosing the best car insurance requires careful consideration of various factors. This includes understanding coverage options, evaluating insurance providers, and comparing quotes and premiums. By analyzing these aspects analytically and objectively, one can make an informed decision that suits their specific needs.

Remember to weigh factors such as cost, coverage limits, deductibles, and customer service. By following this unbiased approach to selection, individuals can enjoy peace of mind knowing they have chosen the optimal car insurance policy that perfectly aligns with their requirements.